Traders, prepare to adapt.

Wall Street is entering a new era. The fraternity of bond jockeys, derivatives mavens and stock pickers who’ve long personified the industry are giving way to algorithms, and soon, artificial intelligence.

Banks and investment funds have been tinkering for years, prompting anxiety for employees. Now, firms are rolling out machine-learning software to suggest bets, set prices and craft hedges. The tools will relieve staff of routine tasks and offer an edge to those who stay. But one day, machines may not need much help. It’s no wonder most of the jobs Goldman Sachs Group Inc.’s securities business posted online in recent months were for tech talent. Billionaire trader Steven Cohen is experimenting with automating his top money managers. Venture capitalist Marc Andreessen has said 100,000 financial workers aren’t needed to keep money flowing.

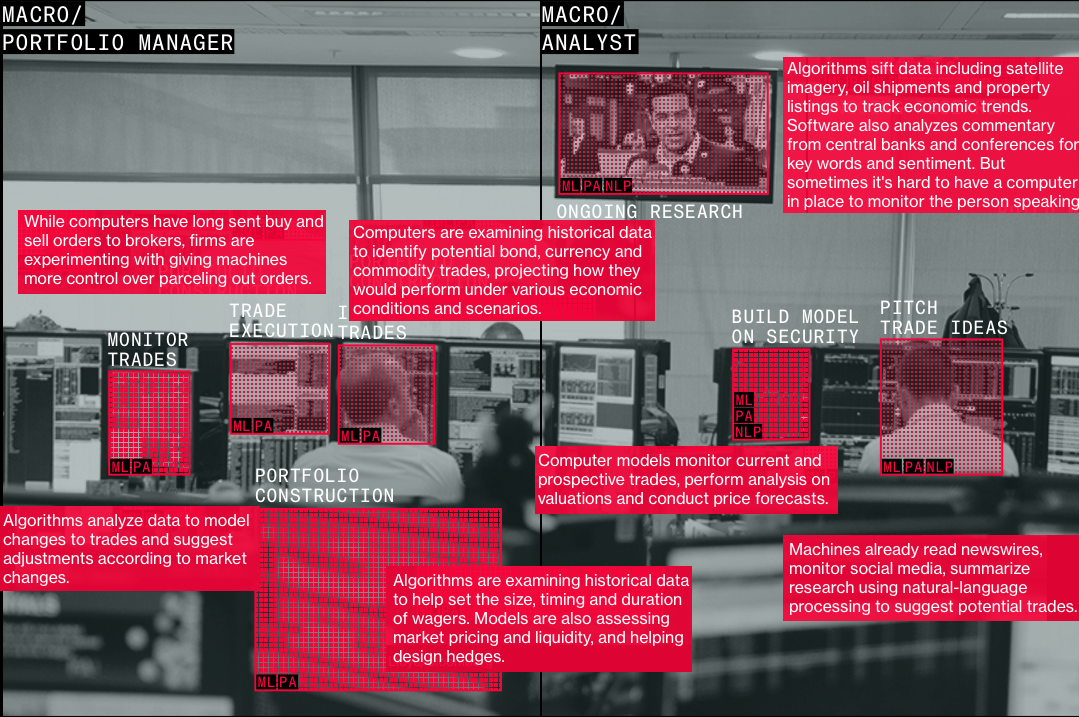

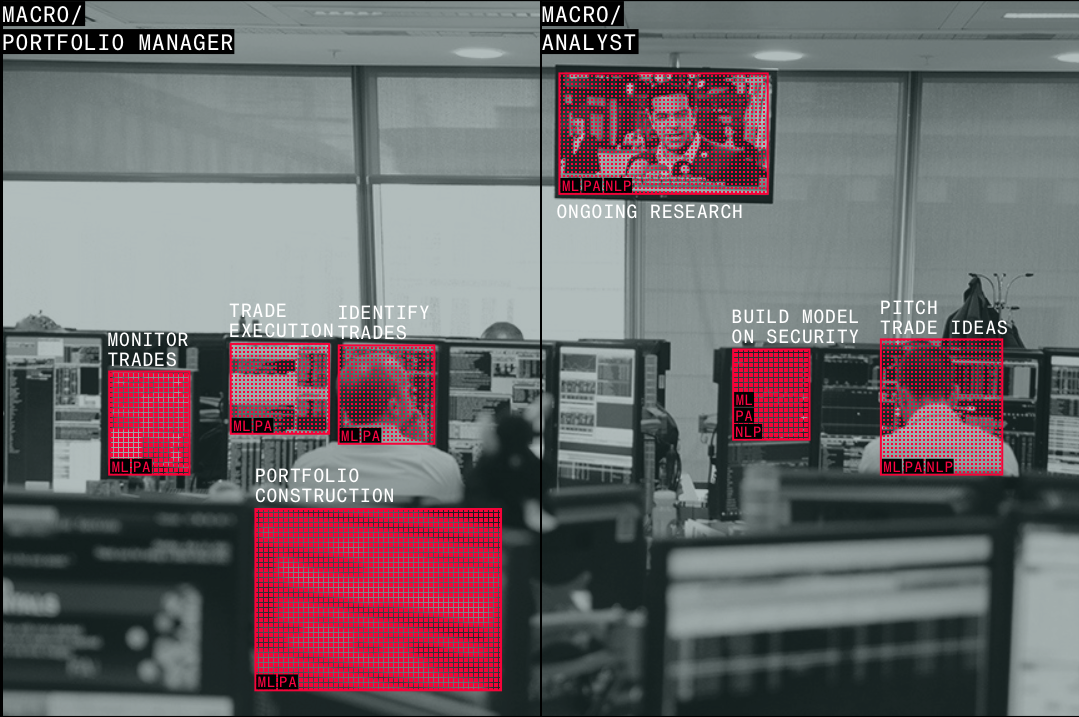

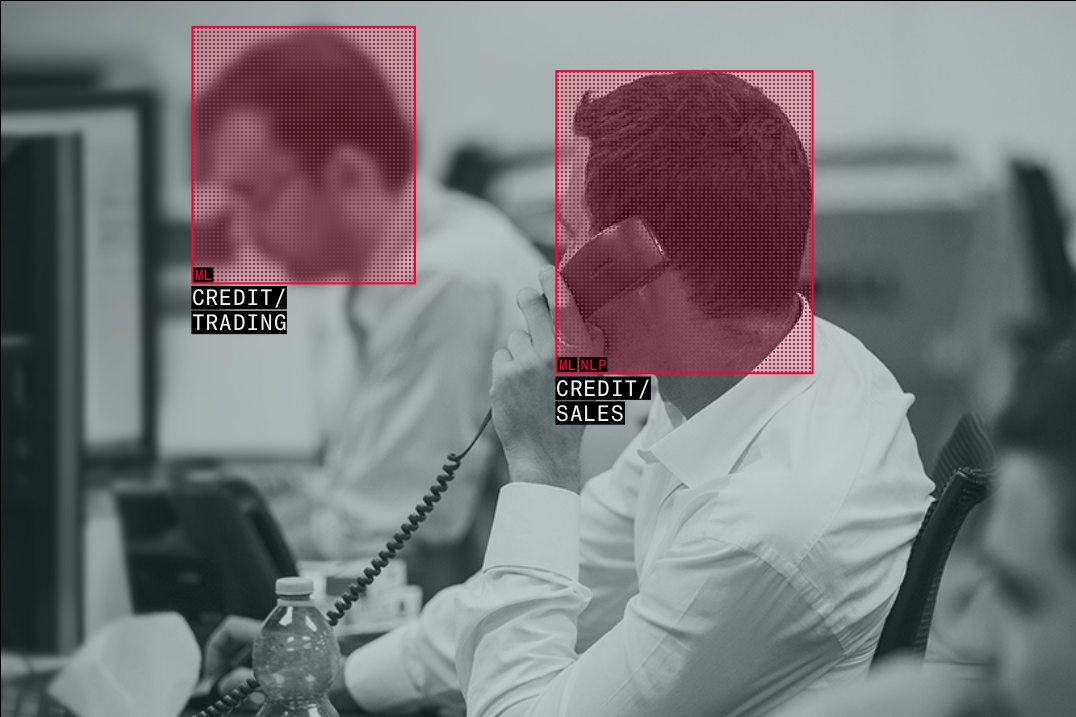

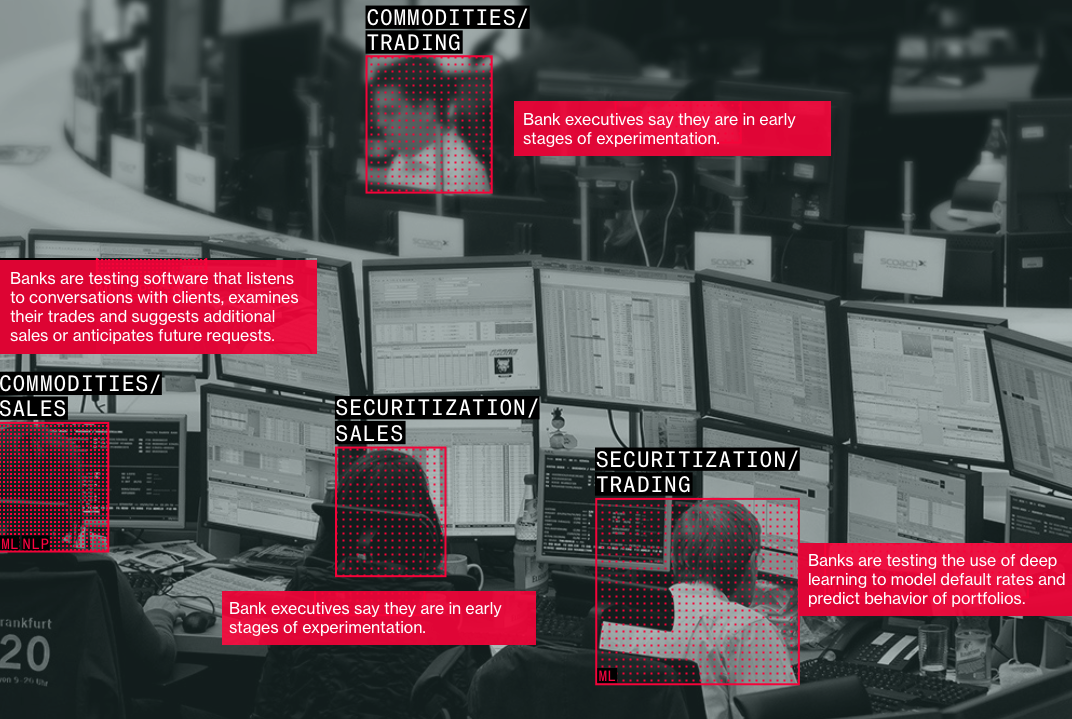

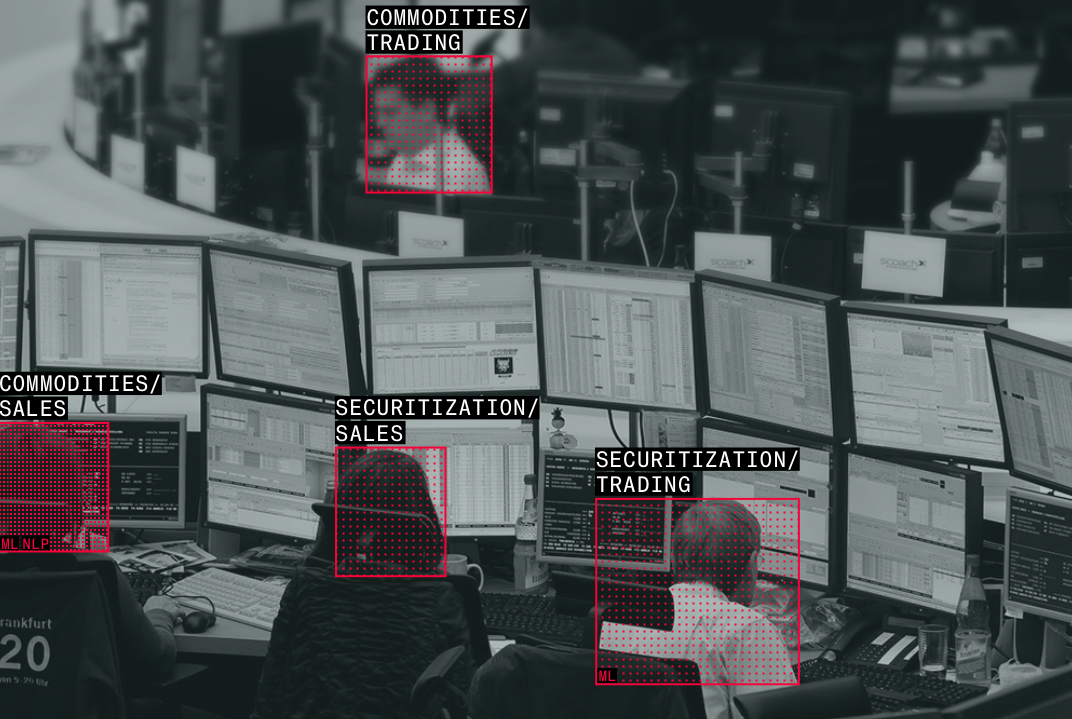

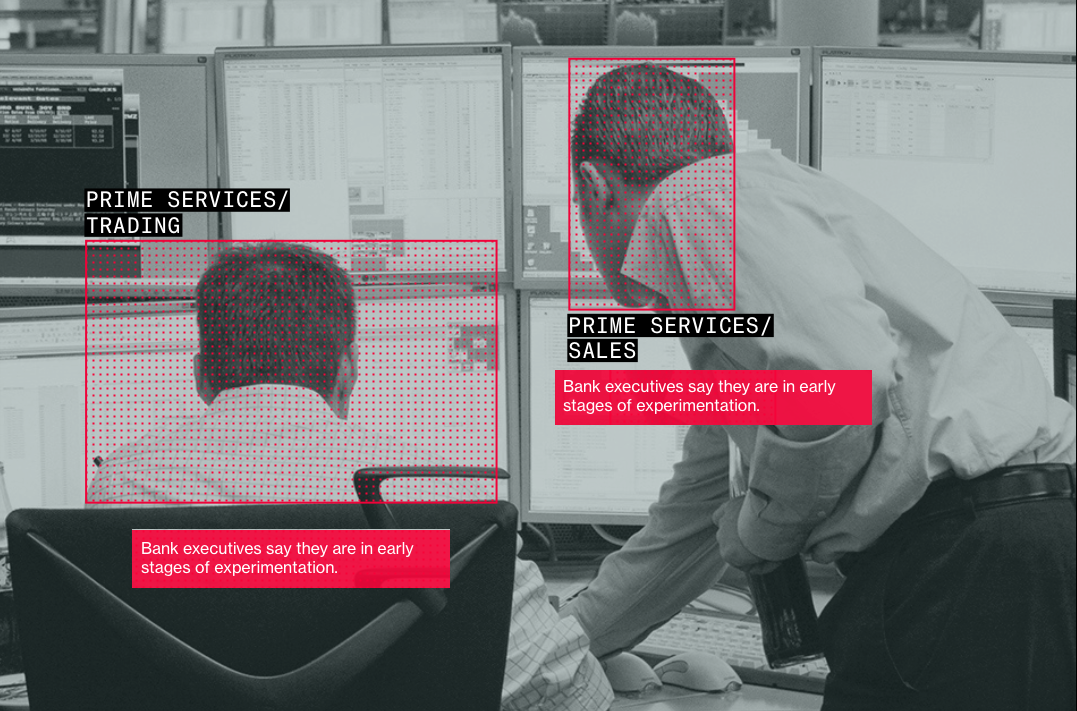

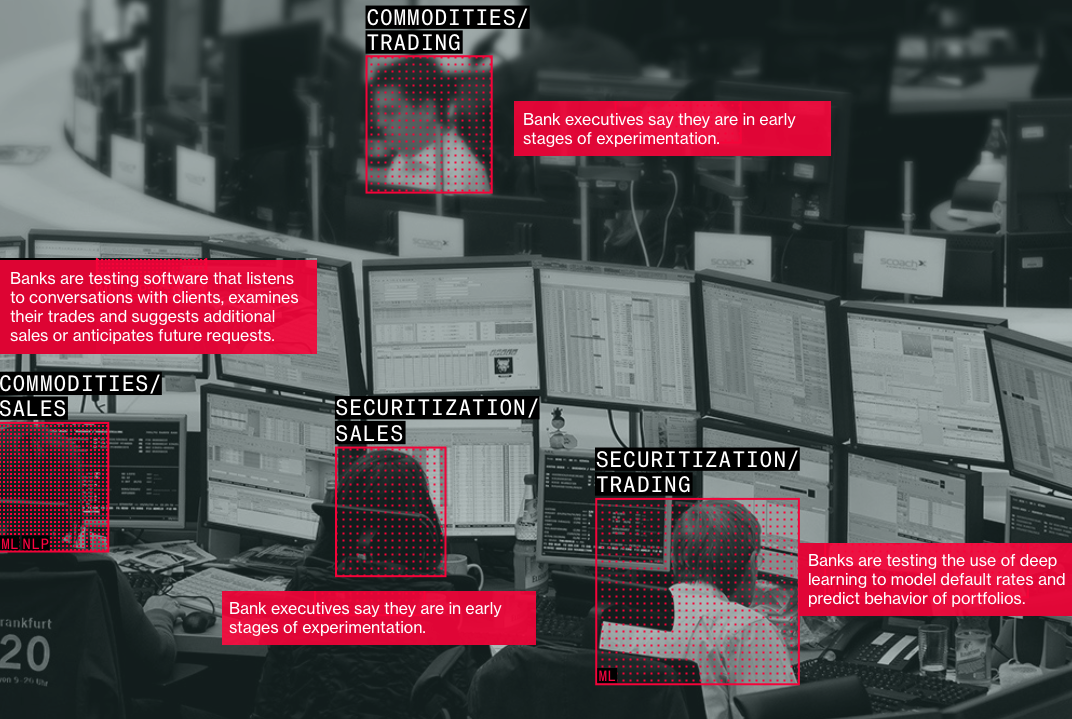

This map of trading automation is based on interviews with about a dozen senior banking and investing executives on Wall Street, many of whom focus on adopting new tech. It offers a sense of their projects — some of them just starting — that will affect traders within big firms.

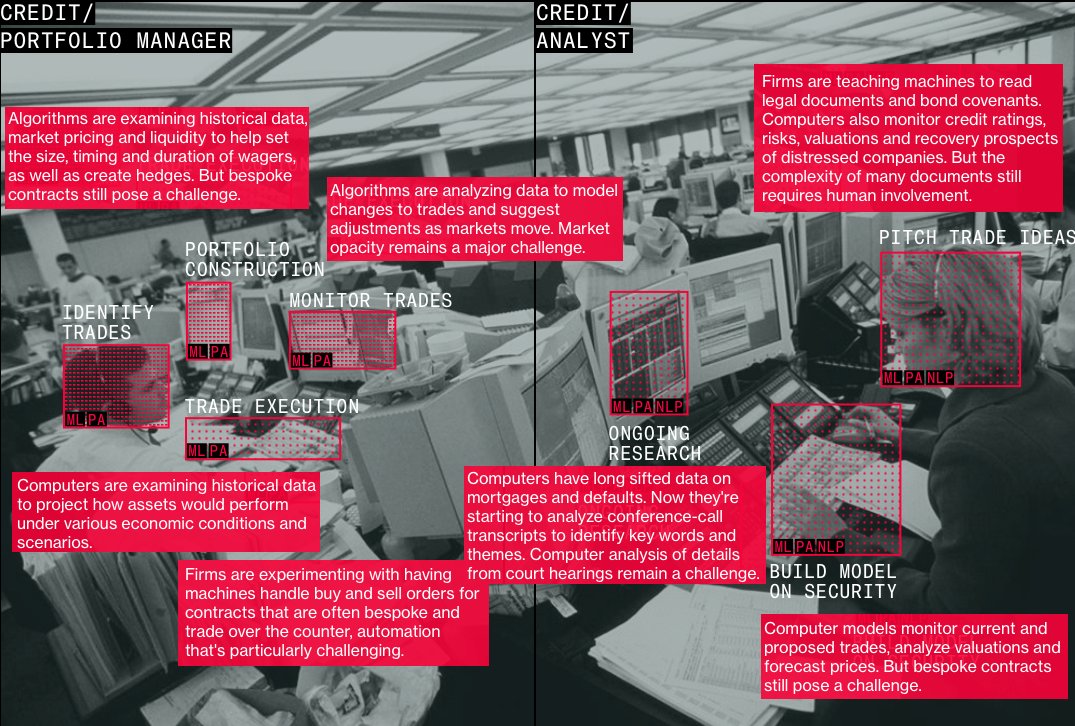

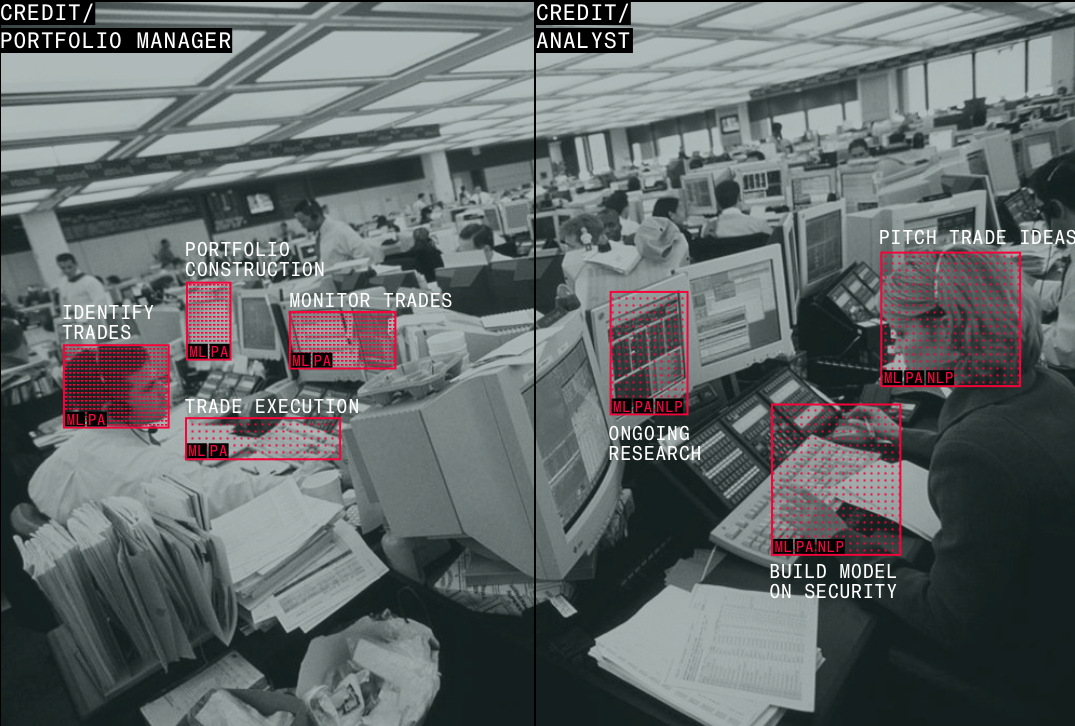

SELL SIDE / CREDIT

SELL SIDE / RATES AND FX

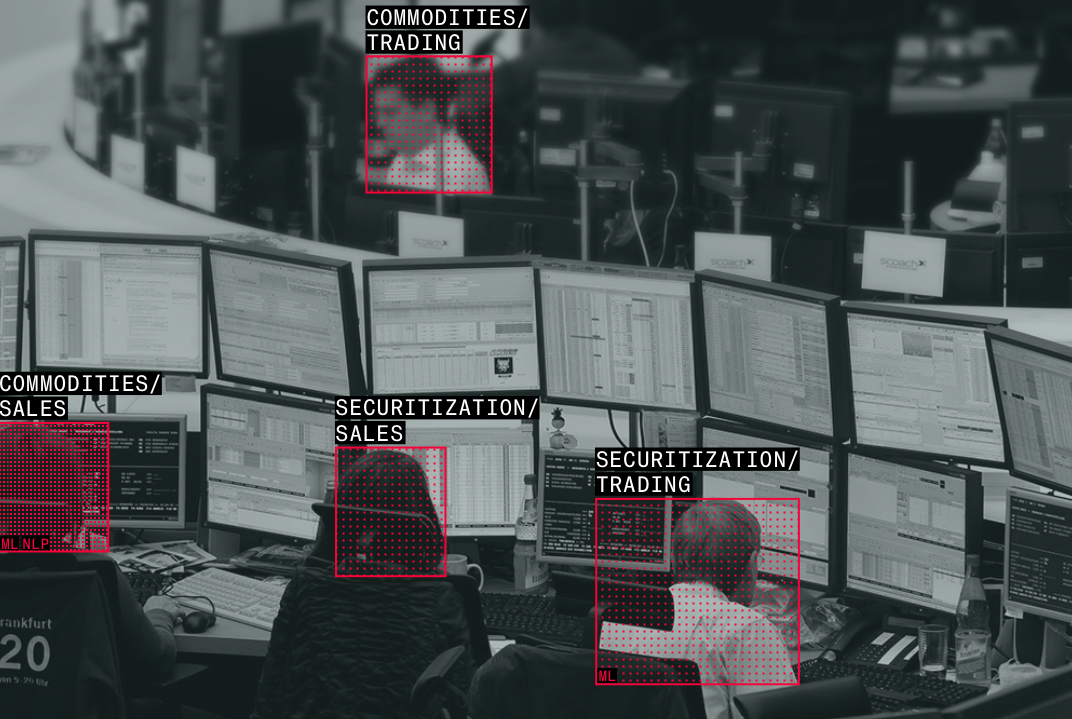

SELL SIDE / COMMODITIES AND SECURITIZATION

From highly liquid contracts tied to assets like gold and oil to the physical commodities themselves, the diverse world of commodities doesn’t always lend itself to automation. So banks are working on cataloging trader and salesperson conversations to create profiles of clients to help better anticipate their desires.

SELL SIDE / EQUITIES

Equities trading, which shifted decades ago to electronic platforms, is one of the first testing grounds for using artificial intelligence to execute orders.

BUY SIDE / EQUITIES

Hedge funds and asset managers are using predictive analytics for tasks such as timing stock purchases and assessing risk based on market liquidity. Computers are also digesting vast data sets — everything from car registrations to oil-drilling concessions — to help predict how stocks will perform.

BUY SIDE / CREDIT

Vast spreadsheets, such as breakdowns of mortgages packed into bonds, are nothing new for credit funds. But some are teaching computers to scan and understand a much larger universe of bond covenants, legal documents and court rulings. Still, fully automating analysis of contract and illiquid assets underpinning securities in opaque markets remains a challenge, for now.

BUY SIDE / MACRO

Firms are trying to build economists. They’re toying with natural-language processing to sift central bank commentary for clues on future monetary policy. They’re also experimenting with algorithms that scour far-flung data, like oil-tanker shipments from the Middle East or satellite images of Chinese industrial sites, to forecast growth.