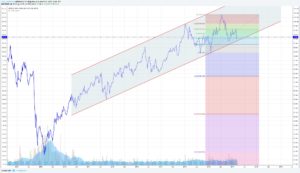

This chart reflects how ETF (IYR) real estate continues to weaken than the market over the past 10 years. This downward movement checks the lows of the 2009 financial crisis.

Many are of the opinion that the ETF (IYR) wins from lower rates and faces the problem when the rates are higher. If the Fed raised rates today or in the near future will raise, will it put pressure on the ETF (IYR)

What makes the ratio on the upper chart at the level (testing the lows of the financial crisis) and what the DJ Home Construction index does, can say a lot about the fact that “reflex trade” reaches its peak or is really going to gain speed to growth.

It would be very interesting to see how two different games with real estate play simultaneously in the support / breakthrough tests, FED is looking at raising rates today.